Calculating payroll taxes 2023

Oregons upcoming Paid Family and Medical Leave Insurance PFMLI program starts in 2023 with employee and employer payroll contributions. Household EmployerEmployee Tax Rates.

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Originally Oregons PFMLI was set to start on January 1 2022.

. For fiscal 2023 ending April 30 2023. As such the total contribution rate is 9 of salaries per annum with both the employer and the employee splitting the 9 contribution equally. You must pay these payroll taxes to the tax authorities.

UBD to Tax and Customs Administration to change Effective date. The payroll tax rate reverted to 545 on 1 July 2022. Wage tax on share options delayed for employers Effective date.

As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. To get you off to a good start with your business tax deductions Uber provides you with a tax summary that breaks down the totals of the amounts on both your 1099-K and 1099-NEC. They are counselors and teachers who can provide year-round tax support.

Please fill out the form to receive a free copy of our Belgium payroll taxes and benefits guide. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. The employee contributions to the NP scheme are deductible in calculating taxable income.

For real estate salespersons read Revenue Ruling PTA 025v2. Taxable remuneration includes the sum of wagessalaries and benefits paid in cash or in kind to employees self-employed persons and deemed employees as a result of. Unfortunately when you are self-employed you pay both portions of these taxesfor a total of 153 percent.

Fiscal Year 2023 beginning July 1 2022 is not a leap year. The CERS Board of Trustees met on December 1 2021 and adopted CERS employer contribution rates for Fiscal Year for Fiscal Year 2023. This income amount is also used on Schedule SE in calculating your self-employment taxes for Medicare and Social Security.

David Burt JP MP resulted in the following amendments to Payroll Tax. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Calculating Medicare Tax Once the 2400 threshold is met all wages are considered when calculating the dollar amount of an employees Medicare tax.

Estimating your income tax. However you get to claim a deduction for a portion of this when you file your tax return. If you live in a zone for less than 183 days in 202223 you may still be able to claim a tax offset if you meet each of the following 3 conditions.

Do we know when the 20222023 mandatory annual salary increases will need to be applied please. Total revenue of 1739 million was up 50 year-over-year due primarily to strong organic growth and 168 million in revenue from our acquisitions of NuORDER and Ecwid. Under the Illinois Family Relief Plan Public Act 102-0700 passed by the Illinois House and Senate temporary reductions in taxes were enacted with regard to groceries back-to-school items and motor fuel.

State governments have not imposed income taxes since World War IIOn individuals income tax is levied at progressive rates and at one of two rates for corporationsThe income of partnerships and trusts is not taxed directly but is taxed on its. You have to deduct payroll tax from your employees wages. Find a Tax Pro Near You For 20 years weve been matching people with tax pros who serve with excellence.

Four consecutive no payroll reports will result in an automatic suspension of the employer account by the division. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations. Calculating payroll taxes Dutch Tax and Customs Administration This article.

1 day agoSocial Securitys payroll tax works out to 124 for the self-employed. These rates are effective July 2022 and were set in accordance with KRS 615655 which caps CERS employer contribution rate increases up to 12 over the prior fiscal year for the period of July 1 2018 to June 30 2028. Payroll and moreso you can focus more on serving your customers.

But instead of integrating that into a general. 183 days or more during the period 1 July 2021 30 June 2023 including at least one day in 202223 and you did not claim a zone tax offset in your 202122 tax return. Employees are also required to contribute an amount equal to 45 of their salaries.

The tax rate calculation. Tax rates effective January 1 2023 through December 31 2025 will exclude charges from the second third and fourth quarters of 2020 and all benefit charges paid as a direct result of a government order to close or reduce capacity of a business due to COVID-19 as determined by the Department of Economic Opportunity. Employers who have paid no wages during a calendar quarter will not owe any taxes.

Payroll Tax Amendments for 2022The budget statement delivered on Friday February 25 2022 by the Premier and Finance Minister the Hon. Calculating Bi-Weekly Gross Using Annual Salary. Employees can use benefits beginning September 1 2023.

Payroll Tax levied under the Payroll Tax Act 1995 and the Payroll Tax Rates Act 1995 is a tax on all employers self-employed persons and deemed employees on the remuneration paid in their business. Learn about employment payroll and immigration for Belgium to help your company with local legislation. However they are still required to submit an Employers Quarterly Contribution and Wage Report online.

New Hire Relief The New Hire tax incentives offered in 2018 and again in 2020 have been extended through to March 31 2024. Total revenue is expected to be between 1080 million and 1086 million representing 26 year-over-year growth at the midpoint 30 year-over-year. RamseyTrusted tax advisors do more than file your taxes.

365 days in a year please use 366 for leap years. The employers social security contributions in Belgium amount to 25 to be calculated on uncapped income. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID.

Meanwhile if you work for a business or someone else you and your employer split the payroll tax down the middle 62. You must also inform the aide about the Earned Income Tax Credit EITC which can reduce the amount that a low-income earner owes in taxes. For more information on calculating the motor vehicle allowance read the allowances page.

In the event of a conflict between the information from the Pay Rate Calculator and the Payroll Management System calculations from the Payroll Management System prevail. In Belgium there are no payroll taxes applicable other than those for social security contributions see below and income tax withholding. Calculating taxes for your small.

The exempt rate per km used for payroll tax is the ATO prescribed rate for the financial year immediately before the financial year in which the allowance is paid. You calculate these employment taxes on a Schedule SE attachment to your personal tax return.

Business Operating Budget Template Operating Budget Template Operating Budget Template What To Know About I Budget Template Free Budget Template Budgeting

Pack Of 28 Pay Salary Slips Templates Free Daily Life Docs Payroll Template Word Template Words

2022 Federal State Payroll Tax Rates For Employers

How To Pay Payroll Taxes A Step By Step Guide

2022 Federal State Payroll Tax Rates For Employers

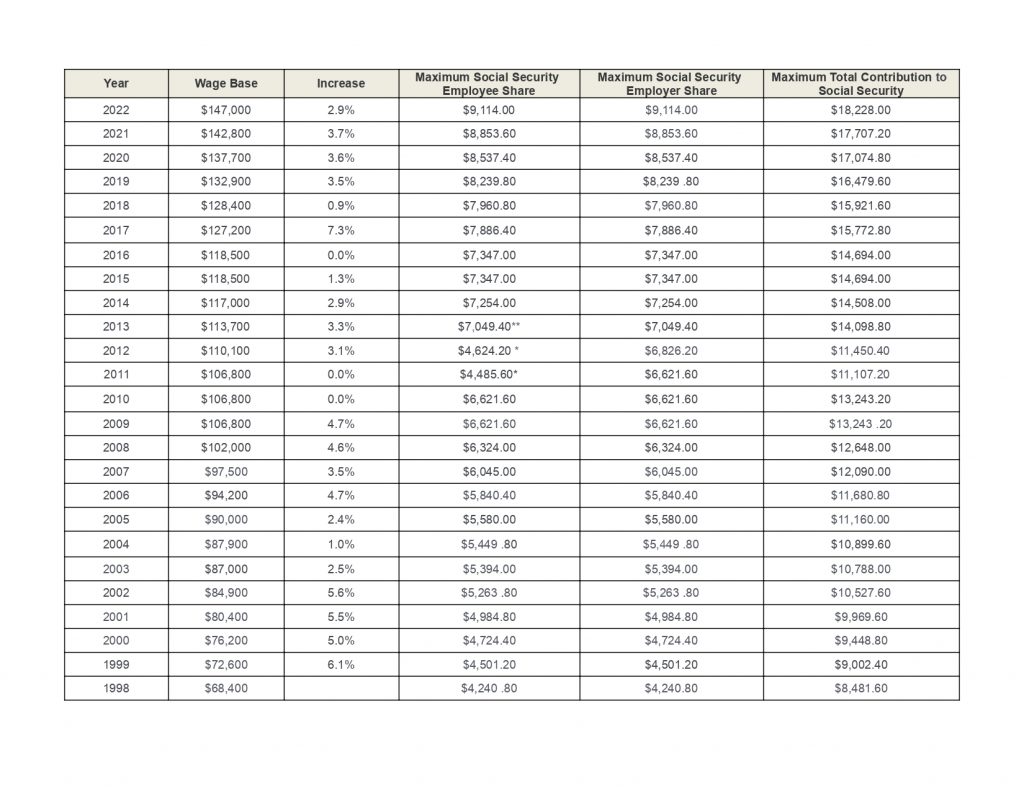

Social Security What Is The Wage Base For 2023 Gobankingrates

When Are Federal Payroll Taxes Due Deadlines Form Types More

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

2022 Federal State Payroll Tax Rates For Employers

When Are Federal Payroll Taxes Due Deadlines Form Types More

Page Not Found Isle Of Man Isle Quiet Beach

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

2

What S In Your Pantry Pantry Inventory Printable Checklist Pantry Inventory Pantry Inventory Printable Pantry Inventory Sheet

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

How To Pay Payroll Taxes A Step By Step Guide

2022 Federal Payroll Tax Rates Abacus Payroll